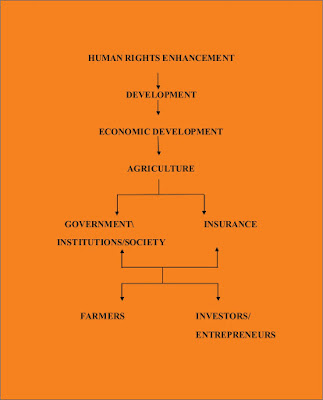

Insurance is a right, a socio-economic right that is very

relevant to the human rights enhancement and it should be well enhanced and

explored to maximize full potentials.

Everyone makes mistakes, and insurance agents are not

immune. The very complexity of the insurance business creates numerous

opportunities for errors and omissions to creep into an agency's operation.

The E&O claim is the insurance agent's malpractice suit.

Agents follow closely behind doctors and lawyers as subjects of an increasing

number of claims alleging professional misconduct and negligence. Not only has

the number of claims against agents increased, but the size of the claims has

increased as well. Legislated tort reforms have helped stem the tide, but the

overall trend continue.

Insurance Agent's

Legal Responsibilities.

An insurance agent serves two masters the insured and the

insurer. (In the context of this article, an insured includes one who thought

he or she was insured, whether they were or not.)

The agent's legal responsibilities to the client arise out

of:

common law theories of negligence, and

an implied contract to procure insurance for the insured.

The agent's legal responsibilities to the insurer arise out

of:

common law theories of negligence, and

the written contract that ties the agency to the insurer.

Common Law Negligence

Negligence is defined as "failing to do something that

a reasonable and prudent person would do, or doing something which a reasonable

or prudent person would not do." The criteria against which actions are

measured, therefore, are subject to change over time, and the prudent person

against whom one is measured is intended to be a peer.

It is clear from this definition and it's reference to a

"reasonably prudent agent" that the actions of an insurance agent in

a specific case will be examined and evaluated based on the facts and

circumstances involved in that case. The standard against which an agent will

be measured depends on the "state of the art" of insurance agency

procedures and operations existing at the time of the loss. An agent's duty to

an insured, therefore, constantly is evolving with the times.

Professional or Sales person? One implication of the definition

of negligence is that the higher the level of experience, education or skills

involved, the higher the standard of care against which actions will be judged.

Thus an insurance agent who holds himself out to be a professional through

written or oral representations and appearances raises the standard of care

against which actions will be judged.

Client Relationships. In addition to an agent's

perceived professionalism, an established "course of dealing" or a

"special relationship" with an insured can affect the degree of the

agent's legal responsibility to the insured. If an agent consistently renews

insurance policies for an insured over a period of years, for example, the

agent has established a "course of dealing" and may then be held

liable for failure to renew. An agent that counsels the insured on needed

coverage, thereby creating a "special relationship" with the insured

as an insurance consultant, can be held liable for failing to mention a

coverage that the insured does not have in effect at the time of a loss.

Common Law Duties of

an Agent to its Insured

Under common law, an insurance agent owes a duty to use the

degree of care necessary to protect the interest of the insured. If failure to

use care results in injury or damage to the insured, the agent can be held

liable for the injury or damage. Of course, the agency is also responsible for

the negligent or fraudulent acts of its employees and solicitors.

For an agent to be legally liable for negligence, the injured

party (the plaintiff) must prove the following:

the agent owed a legal duty to the plaintiff;

there was a breach of that duty by the agent; and

the damages suffered by the plaintiff were proximately

caused by the breach of duty.

General Duty to Act

Reasonably. An agent generally has a duty to act as a reasonably prudent

agent would act in the same or similar circumstances. Texas courts have defined

the duty owed to the insured as follows:

"An agent owes his clients the greatest possible duty.

He is the one the insured looks to and relies upon. The insured looks to the

agent he deals with to get the coverage he seeks, with a sound company who can

and will promptly pay claims when they are due. It is his duty to keep his

clients fully informed so that they can remain safely insured at all

times." ( Trinity Universal Insurance Company v. Burnette - Texas, 1977. )

This general duty to act reasonably has been softened

somewhat over the years by various court decisions that described certain

specific duties of insurance agents. The following common legal theories for

errors and omissions claims illustrate the degree of care recognized in common

law:

Misrepresenting insurance coverage. An insurance agent may

no misrepresent the existence or the extent of coverage provided in a policy.

Failure to procure

requested insurance. An insurance

agent who undertakes to procure insurance for another owes a duty to use

reasonable diligence in attempting to place the requested insurance.

Failure to notify insured of inability to procure insurance.

As an expansion of the above theory, an insurance agent owes a duty to inform

the insured promptly if unable to place the requested insurance.

Procurement of inadequate coverage. An insurance agent

who agrees to provide insurance to an insured owes a duty to use reasonable

care to obtain adequate insurance to meet the insured's needs.

Failure to maintain requested insurance. An insurance agent owes a duty

to inform the insured when a renewal policy contains coverage changes.

Failure to inform

insured of renewal. An insurance agent owes a duty to inform the insured of

premiums due for a renewal when the agent receives information pertaining to

the expiration date that is intended for the customer.

Failure to investigate

an insurer's financial solvency. An

insurance agent owes a duty to place coverage with a solvent insurer,

reasonably monitor an insurer's financial condition, disclose solvency

information to the insured, and protect the insured when the risk of insolvency

becomes too great.

Duty to Explain

Policy Terms

Does an agent have a duty to explain policy terms and cover

ages to customers? Does an agent have a duty to offer higher limits or

additional cover ages? Generally, the courts have said the answer to these

questions is "NO." As is the case with most E&O loss exposures,

however, an agent can get sued for failing to explain or offer cover ages, even

if there is no legal duty to do so based on previous court decisions. That's

why loss prevention measures are so important.

Client relationships can affect the success or failure of a

client's claim against the agency. An established "special

relationship" with an insured can affect the degree of the agent's legal

responsibility to the insured.

If an agent counsels the insured on policy terms or needed coverage

, for example, a judge or jury may say that the agent has established a

"special relationship" with the client and may hold the agent liable

for failing to explain a coverage or exclusion, or for failing to mention a

coverage that the insured does not have at the time of the loss.

Without this special relationship, however, the courts have

fairly consistently refused to blame the agent for a policyholder's failure to

read and understand his or her policy, or for not providing coverage for every

conceivable loss.

Duties of an Agent to

its Company

An insurance agent may be liable to an insurance company for

negligence or a breach of contract that causes loss or damage to the company.

In particular, the agent owes the insurer loyalty, fairness and honesty, and a

duty to act in good faith and to keep the insurer informed of material matters

that relate to the insurance or to the agency/company relationship. An agency

may also be liable for the negligent or fraudulent acts of agency employees and

solicitors.

The agency/company contract creates a "special

relationship" between the agent and insurer, thereby increasing the

required degree of care. In addition, an agent has a fiduciary relationship

with an insurer that requires an extraordinary degree of care. An agent's duty

of care to an insurer is illustrated by the following common types of errors:

Making mistakes.

An agent owes a duty to use reasonable diligence and care in conducting

business with its insurers. An insurer may be held liable for an agent's error

in processing an insured's request for coverage, but the insurer may then have

a right to seek indemnification from the agent.

Failing to follow company instructions. An insurance agent owes a duty to comply with a an insurer's instructions promptly and fully and may be liable for any loss the insurer incurs as a result of the agent's failure to do so.

Failing to disclose

information. An agent has a fiduciary duty to the insurer to disclose any

pertinent information related to the policies the insurer assumes for the

agent.

Delay in forwarding

information. An agent owes a duty to use reasonable diligence in forwarding

information that has been requested by the insurer or is material to the

insurance.

Exceeding the express

or implied authority the company gives the agent.

An agent owes a duty to understand and comply with binding

authorities granted by the insurer and comply with all other terms of the

agency/company agreement.

No comments:

Post a Comment